Disclosure: This post may contain affiliate links, meaning if you decide to make a purchase via my links, I may earn a commission at no additional cost to you. See my disclosure for more info.

This holiday season, instead of just spending on gifts, why not invest in the best present you can give yourself: financial independence (FI)?

WHAT IS FI & WHY START NOW?

- Financial independence means taking control of your future, and there’s no better time to start than now—right before the holiday spending frenzy begins.

- Financial independence isn’t about how much you make—it’s about how much you save. It’s the ability to comfortably cover all your living expenses without needing a paycheck.

- Financial independence is about freedom: the freedom to choose how you spend your time, pursue passions, or even redefine ‘retirement.’

Disclaimer: Just a heads-up: I’m not a financial advisor, but I’m sharing what has worked for my family.

Pause and Reflect

Before diving into your FI journey, take a moment to assess where you stand financially:

- Do you know how much money you’re on track to have for retirement at your current savings rate?

- Have you saved 3–6 months’ worth of living expenses for emergencies?

- Are you free of high-interest debt (anything over 5%), and are you making the most of tax-advantaged accounts like a 401(k) or HSA?

If any of these made you pause or feel uncertain, don’t worry—there’s no better time to start than now.

OUR FAMILY’S FI JOURNEY

If you’re wondering what this looks like in real life, here’s how my family got started…

SETTING THE GOAL

In July 2023, my family and I started our FI journey, and according to my calculation, we will be financially free by 2029. By staying consistent, we’ve increased our net worth by 60% in just one year. And I’m the sole provider of the household. So doing this on one income while living in one of the most expensive places on the planet—California—is still absolutely doable.

Those who know me well know that I’ll likely never stop working once we reach financial independence, but work will become a choice versus a must.

TRACKING PROGRESS

To ensure our family stays the course to reach our FI goal, we have a monthly finance meeting together. We start by reviewing our uber goal, which is what we plan to do when we reach FI. Because I have two adolescent sons whose ideas and desires change often, we tend to think about different areas of the world we could see ourselves living in, all while keeping our house in California. Together, we imagine our dream life in those places—brainstorming everything from building a house to running family businesses.

TEACHING KIDS ABOUT FINANCIAL LITERACY

Then we get into the numbers. We first look at our net worth. Net worth is easy to calculate. It’s your total assets minus your total liabilities. We know what our family net worth number needs to be for us to be financially free, so we track our progress toward that FI number every month. My kids always get excited to see our month over month progress. And it’s fun to see them understand how money works and to see it grow. Sometimes when the market takes a dip, they’ll ask why our month over month number has gone down. I love those opportunities to be able to teach them about how markets work and why those dips are normal.

We then look at all our expenses. This is an essential reminder to ensure we keep our spending in check and don’t go off the rails. I always show the last 3 months of expenses so they can see the comparison and ask questions about month-over-month deviations. There will always be more expensive months than others, but we’ve noticed that consistently categorizing our expenses on a weekly basis, then generating the monthly report for the meeting, keeps us very aware of where we are spending silly money and to shut it down quickly.

Just remember: any monthly cost multiplied by 173 is what it could grow to in 10 years if invested instead. Remember that next time you want to buy or lease another brand-new car. Do you want to delay your financial freedom by 5+ years or invest the money in buying your freedom instead?

We don’t discuss how much I make, because kids talk and it’s nobody’s business, but we do go through how much and what we are investing in and if we have any room to increase or not. Basically, anywhere where we think we can cut spending, we take those savings and invest them into our Vanguard’s index funds. My favorites are: VTSAX, VTIAX, and VBTLX.

The very first family finance meeting lasted almost 90 minutes and was quite tortuous for Jason, ha! He was so bored; he fell asleep half-way through. But it took so long because I had to explain a lot since most of the concepts and terminology were new to them. Now, the meetings usually last about 20 minutes and we do it over dinner. I project my laptop to our TV and quickly take the fam through our net worth progress and expenses. Since everyone’s familiar with the format and terminology, it’s a quick update.

HOW TO START YOUR FI JOURNEY: STEP-BY-STEP GUIDE

To run your family’s monthly finance meetings like a well-oiled machine, you need to start your FI journey. It’s not hard to get started, you just need to dedicate some time to getting organized. There’s no one-size-fits-all approach. Tweak these steps to suit your family’s goals and lifestyle:

- Step 1: Lay Your Financial Foundation.

- Pay off expensive debt (5% interest or higher).

- Build an emergency fund of 3-6 months’ worth of expenses.

- Determine what you want to do once you reach FI.

- Determine your FI number. Your FI number is your yearly expenses after retirement multiplied by 25. For example, if you’ll need $10,000 per month, you’ll need $3 million in investments to retire comfortably. You can include the equity in your house, should you own one and you assume you will sell it and use the money to live off of. I exclude it from our family’s calculation.

- Determine your FI date. Mad Fientist’s FI tracker tool is great for calculating this. You can use it month over month to see how the date changes as you increase or savings/wealth growth rate.

- Step 2: Increase your Gap.

- If you don’t use anything to track your money, download and install Empower Personal Capital. This free app tracks your spending, shows you where your money is going, and shows you your assets and net worth.

- Categorize the last 3 months of expenses. I think categorizing the last 12 months is better but if you can’t go back that far for whatever reason, at least go back 3 months.

- Then bucket your expenses into 3 categories: fixed costs (little to no reductions possible), reducible costs (required costs that can be reduced like groceries, restaurants, etc), discretionary costs (things you can pay off or cancel completely).

- From the discretionary bucket: pay off anything in full that you can. Take a close look at subscriptions and memberships—are they really adding joy to your life? If not, let them go and redirect that money to your future freedom fund. For us, cutting down on subscription services saved $305/month—money we now invest instead.

- Calculate how much money you’ve freed up and start saving ALL OF IT off to the side for now. I’d suggest opening a high interest saving account from Discover or CIT and start saving that rainy day money there.

- Step 3: Increase your Savings/Wealth Growth Rate.

- Saving 10% for the rest of your life won’t get you far. If you want financial freedom now while you are still young and fit, then you need to increase your savings/wealth growth rate to more like 50-70%. I know you’ll say it’s impossible but it’s not. It’s all a matter of priority.

- Continue to kick up your savings rate a notch every month until you hit the sweet spot. Or you could start really high at 80% and take it down a notch every month until you hit the sweet spot. Either way you’ll know what’s right for you and your family once you hit it. You should still enjoy life but be conscious that every big expenditure will add time to your working life.

- I went from saving 17% of my income to 51% in only 10 weeks. We are at around 60% now and that feels right for us.

- Step 4: Optimize your Investments.

- It’s all about the fees, baby. Make sure you are investing in securities or financial assets with the lowest fees possible.

- And BEWARE! Hidden fees are everywhere so be sure to read all the fine print and do your due diligence here. If not, fees can eat into your wealth and ruin all chances of retiring early.

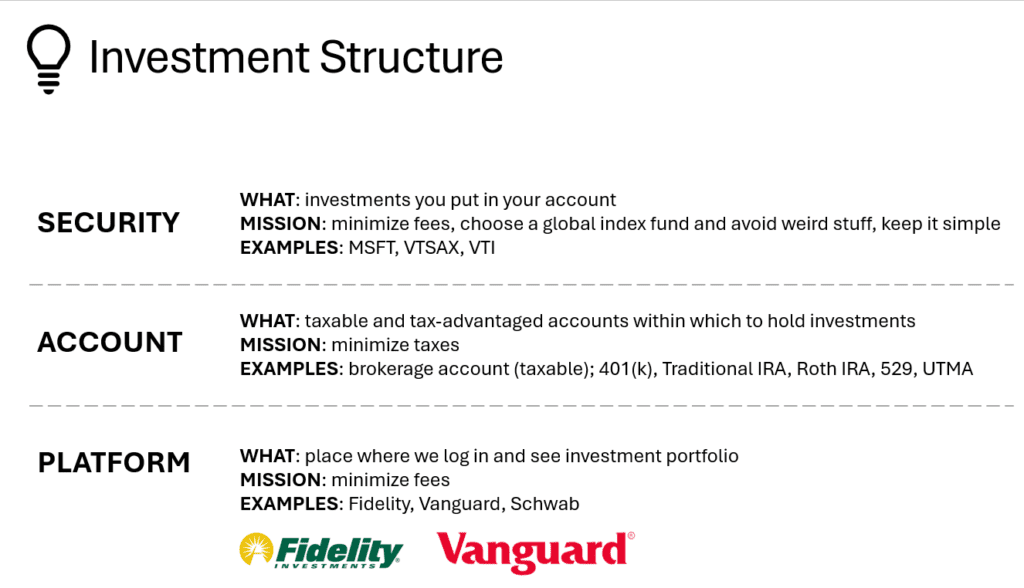

- Understand what the investment structure is. What is a platform versus an account versus a security.

- Simplify your investments and automate everywhere possible. For example, instead of hand-picking different funds to invest in for your 401(k), pick one broad-based global index fund with very low fees and be done with it. No need to keep checking and changing individual investments. Keep it simple and on autopilot.

- Step 5: Optimize your Spending.

- There are several resources with tips on how to reduce and optimize your spending. Try the Frugal Woods uber frugal one-month challenge to really put your family spending to the test. I loved this challenge! My kids…not so much, lol!

- Implement new rules in your house like waiting 72 hours before anyone buys anything to reduce impulse buying and the addiction to Amazon packages showing up everyday.

- Or find a ‘BuyNothing’ local group where people are giving away so. much. stuff. all the time.

- Step 6: Optimize your Taxes.

- The US tax system rewards savers. Take advantage of that by saving in every tax efficient way possible.

- Start with basic strategies like maxing out your 401(k) and HSA contributions. Once you’re comfortable, explore advanced options like backdoor Roth conversions or tax-loss harvesting. More on that and other optimizations like travel hacking and college hacking in future posts.

Your journey to financial independence starts today. Every step you take now is an investment in your future freedom. Let’s do this together—email me at [email protected] with your progress or questions.

Happy Saving y’all!